Accumulate wealth: the long-term way!

Long-term business success, long-term business planning, long-term goal setting, long-term vision, long-term sales/ profits, long-term outcomes, planning for one’s child higher education, purchasing a family insurance. These terms, phrases and actions are inculcated in our daily lives. They sound familiar and we resonate with these phrases as we hear and read about them primarily in the business context or financial planning. From business leaders to students at business school are encouraged to implement a long-term approach to business success and viability. Meanwhile individuals merely rely on savings and short-term investments without conducting research resulting in suboptimal returns sans any suitable approach to create wealth. They are sceptical to take risks and fail to adopt a long-term approach to investments which essentially will create spectacular returns.

Advocates and

proponents of long-term investing like Warren Buffet, Benjamin Graham and

Philip Fisher propagated the idea of long-term investing (in equity markets) underlining

the concept of compounding of assets thus accumulating unexpected wealth. Long

term investing utilizes the fundamental approach to investing tapering risks

and losses . However, this approach requires immense reading and examination of

the investee company than the scrutiny of the stock market or its trends. Psychology

plays a pivotal role in long term investments, it can either make or break the

game. One needs to maintain a logical and practical approach and keep emotions aside.

The investor should consider the investment as business investment rather than

stock market investment. Patience is truly a virtue for the long-term investor.

So how should one explore and follow long-term investing as an investment style?

Individuals are baffled with the dilemma that they require expertise for long-term investing. While one can employ an analyst who is competent in the field or a mutual fund/ investment fund that abide by the concept of long-term investing. Getting acquainted with a few concepts of long-term investing will do no harm and in fact empower individuals to gauge their investments and not merely rely on the decision of mutual funds/investment funds. Usually investing is seen from two sides of the lens. A top-down approach or bottom up approach. The former approach implies that investors, investment managers and analysts scrutinize the economy by spotting trends resulting from secular growth, analysing GDP growth and sectors that have favourable potential or huge growth and later identify companies that are financially stable and worthwhile for investment. While the latter approach is the opposite where companies are enumerated first and analysed upwards i.e. industry/ sector/ economy.

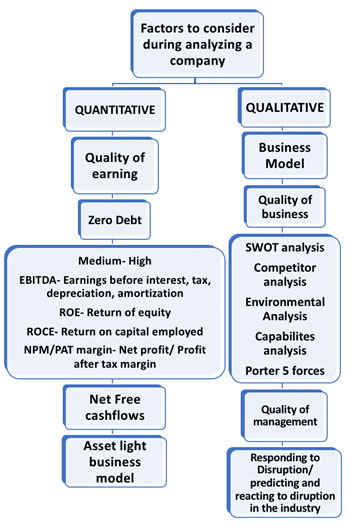

Let’s consider the bottom up approach. Companies are usually selected based on a thorough analysis, examining both the quantitative and qualitative factors of the business. Moreover, it is vital to validate the potential growth rate of the industry remaining consistent in the next few years. Implying the possibility that the business growth will too accelerate around that figure. Quantitative aspects highlight analysing balance sheets, profit and loss statements, cashflow statements and a couple of financial ratios to deem a company’s financial strength. Consistent growth and performance across the last 7-10 years will paint an accurate picture in the investors mind towards investing in a company.

A holistic financial analysis of the company’s financial position is of utmost importance. If it is performing well than only it will lead to accelerating quality of earning (EPS). A company that is generating free cashflows, is operating on zero debt, producing above average EBITDA, ROE, ROCE and PAT ratios can become a part of the stellar list of companies. In addition gauging if the business possess an asset light model (less assets required by the company) is essential as it results in tapered expenses and augmenting profits.

The qualitative aspects principally refer to the strength of the business internally and externally:

What is the business model and is it durable, scalable, feasible?

What are the

products and services offered by the company?

How are they sold?

‘What is the USP

of the products of services?

What is the market

size and size of opportunity?

Is there brand

loyalty and customer loyalty?

Can they predict

disruption and adopt first movers’ advantage?

Are they ready to

react to disruption?

Does it possess

the capabilities to organically grow?

What are its existing

and potential business strategies to grow?

Is the quality of

the management fair and just?

Are they following

corporate governance?

These are generic questions one may confer to while deliberating on the business they would like to invest. Not to miss, considering the longevity of a business is key, its persistence to survive, remain agile and nimble respond to disruptions. A business that can survive for decades or centuries has the possibility to generate phenomenal and spectacular returns if managed by a highly skilled, competent and committed management. Consider the legacy brands like Coca Cola, Mc Donald’s, HP, Exxon mobile, Pfizer and the lists is never-ending.

PS: Extra factors to focus on are listed below:

An amalgamation of

all these factors together constructs a holistic picture of the business and its

suitability for investment. Information on these factors can be accessed from

the company websites, annual reports, quarterly reports, brokerage reports,

insights collected from your network, analysts or primary research carried out

by connecting with suppliers, customers, competitors and other investors.

Prior to purchasing shares or stocks in a company one has to ensure if they are purchasing an overvalued or undervalued stock/ shares. So, what does this mean? Overvalued hints at the fact that you are paying more than what the company is worth and undervalued is you are paying less compared to the value of the company. According to the supreme Benjamin Graham, a value investor purchases shares or stock that is undervalued and has the ability to generate optimal returns ( via capital appreciation as the EPS of the company surges its market capitalization increases and price may equal to value) i.e. in simple words buy cheap and sell high while maintaining a long-term approach. It is all the more necessary to always calculate a margin of safety while investing to avoid loss of money if your predictions fail to come true Or if the company fails to perform as expected.

Implementing a long-term approach highlights the patience and perseverance an investor should have instilled. They need to have the patience to not react to any issues that leads to increase or decrease in the stock prices unless the company is in dire trouble. The predominant measure to consider is EPS (earning per share essentially PAT/no of shares) if that is increasing and company is following strategies (present or future) to grow there shouldn’t be any problem to worry about. Sometimes companies’ numbers (topline/ bottom line) may stagnate, as they may be engaged in new projects/ R&D which leads to surge in CAPEX. Albeit once the project is ready for the market it is usually destined to produce massive result. In addition, usually prices either augment or decline due to trading activity while EPS brings to life the concept of long term investing. It takes time for an undervalued company to evolve as they move up the ladder executing strategies to enter new markets/ introduce/launch new products/diversification/ conduct R&D research/ finalize marketing campaigns. These strategies take substantial time to produce positive outcomes and that’s why sometimes during this period they are out of the radar of investors except value investors.

Being inherently patient during boom or busts will take an investor long way as Warren Buffet famously says be greedy when others are fearful and fearful when others are greedy hence stressing on the focal role of psychology in investing. As long as an investor can track the current and potential trends (industry) and strategies of the business they are on the correct path. Monitoring and evaluating the position of the company, its next moves, innovations, R&D, business deals, expansion strategies and so forth frequently helps one remain an agile and intelligent investor. So if we keep in mind the abovementioned approach and mindset while investing it is very difficult to lose money in stock/business investing. The key here is that long term investing in good franchise or business factors in at least two-three growth phases of a company and business and with compounding effect it surely will be able to create wealth for the investor.

(Disclaimer: The opinions expressed within this article are personal opinions of the author. The facts and opinions appearing in the article are views of the author in general and the author does not hold any legal responsibility or liability for the same.)

Comments

Post a Comment